Credit Counseling

Why Do I Need Consumer Credit Counseling?

Credit card debt can quietly creep into your life. Credit cards can make it challenging to monitor your daily spending. When using cash for purchases, you physically part with the money from your wallet at the point of sale. Each time you visit an ATM or bank teller, you receive frequent reminders of your spending. However, with a credit card, small charges can add up throughout the month. Your smaller spends can add up and turn into a rather big bill by the end of the month. If you don’t pay your credit card bills on time you are likely stacking up additional charges and fees.

Unexpected expenses can occur even for responsible credit card users who maintain their spending within a practical budget. A sudden car or home repair expenses, medical bills, or family emergencies may require you to spend with your credit card more frequently than you needed to. While trying to regain financial stability, it’s easy to lose track of interest payments, minimum payment percentages, and APRs. In tough situations such as this credit counseling services offered by American Consumer Credit Counseling can be a feasible option for you to look at to get your finances in order.

Let’s Look at Some Credit Card Debt Facts…

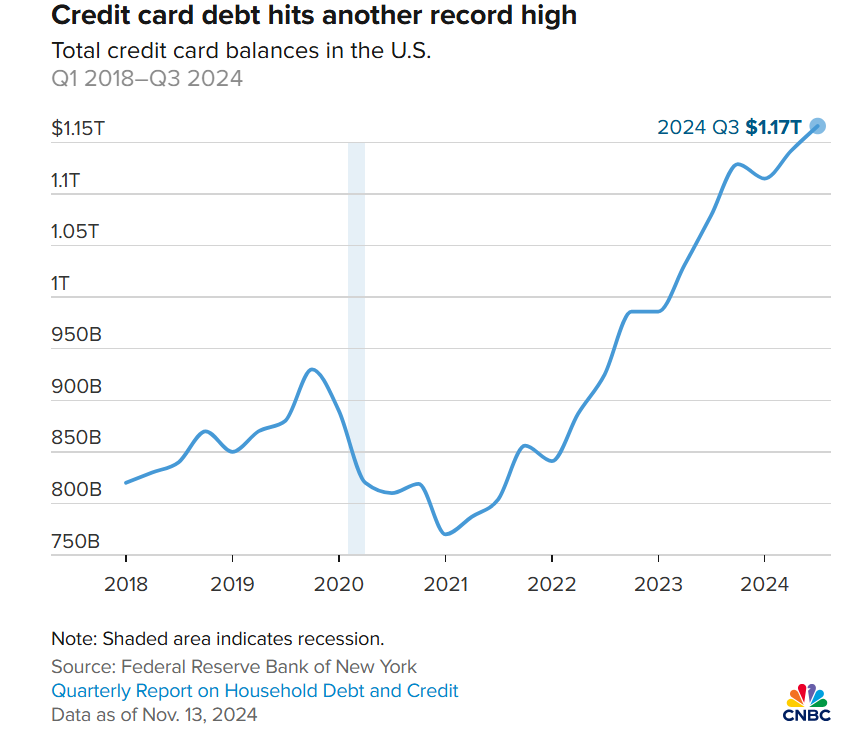

Overall, the national average card debt among cardholders with unpaid balances in the third quarter of 2024 was $7,236, up from $7,130 in the second quarter.

Credit card debt has become a huge issue today. Millions of individuals are facing the consequences of Increasing balances and high-interest rates. This can have significant long-term impacts on your overall financial health. Over the years, credit card balances have consistently seen an upward trend especially post 2014. The pandemic showed a slowdown but as life is kicking back to normal credit card debts are seemingly picking up again. Therefore having a proper debt management plan in place is crucial to the success of your financial management. ACCC experts can help you get there!

Credit Counseling & Debt Management: Overcoming Financial Obstacles

Even for conscientious credit card users that keep their spending within a realistic budget, things can happen. A surprise car expense or home repair, a medical bill or family emergency can turn your credit card from a convenient way to pay into the only way to pay. While working on getting things back to normal, you can lose track of the interest payments, minimum payment percent, and APRs. Even if you’ve collated all the various credit lines into one payment with a consolidation loan, the repayment is still hanging over you.

Individuals facing financial difficulties experience very different situations. That’s why a credit counseling (https://www.consumercredit.com/debt-help/) service is different than simply taking out a consolidation loan. A debt consolidation loan may seem like the only option, but when you contact ACCC’s counseling center, we will help you determine the best way to approach your situation and provide you with the best credit counseling service options possible.

When you contact our counseling agency, a professionally trained debt counselor (https://www.consumercredit.com/what-does-a-debt-counselor-do/) will:

- Help you evaluate your current financial situation.

- Provide you with a detailed review of your income, assets, and expenses.

- Provide personalized options based on your goals.

If the Debt Management Program (https://www.consumercredit.com/debt-programs/debt-management-program/) is your best option, we will provide you with the complete program and details.

At the end of the counseling session, you will feel good knowing that there are options available and that you are not alone. ACCC is here to help and provide you with the best debt solutions for you and your situation.

To discuss your needs, our debt management (https://www.consumercredit.com/) and credit counselors are available:

- Monday–Thursday: 9:00 am to 11:30 pm EST

- Friday: 9:00 am to 8:00 pm EST

- Saturday: 10:00 am to 6:00 pm EST

Are you still not sure if a Debt Management Program is right for you? See what others are saying.

This is an excellent service. AJ was patient and explained every step. He was great to work with. He wasn’t overly assertive and listened as we worked towards a plan.

– Dwayne from CA

This has been an absolutely perfect experience for us. We recommended you guys to our daughter and she just completed the signup process. She was amazed at how uncomplicated it was. It’s always easy to reach someone when I call with a question. 5 Stars!

– Lynette from CA

Catarina was very patient, professional, and efficient in clearly explaining everything. The whole process was much easier than I expected.

– Patricia from CT

The testimonials provided herein are unsolicited comments from clients, based upon their individual needs, concerns, and circumstances. These comments are provided for informational purposes only and should not be construed as a guarantee of similar results or experiences, as each individual’s circumstances will vary. Client comments are included for informational purposes only.