Tax season is usually a hopefully and anxious time. How much of a refund will you get?! Before our couple tries to spend it all, let’s see what they are going to do with their tax refund in the February budget example.

Review of the January Budget

January was a pretty quiet month for our couple. The only incident was some unexpected car maintenance. With all the snow, the couple decided they needed to purchase snow tires. The snow tires cost $650. Usually, this would be a real cause for concern. Fortunately, the new job created a savings payment that will cover the snow tires. And this is why you have savings or an emergency fund built into the budget!

February Budget Example

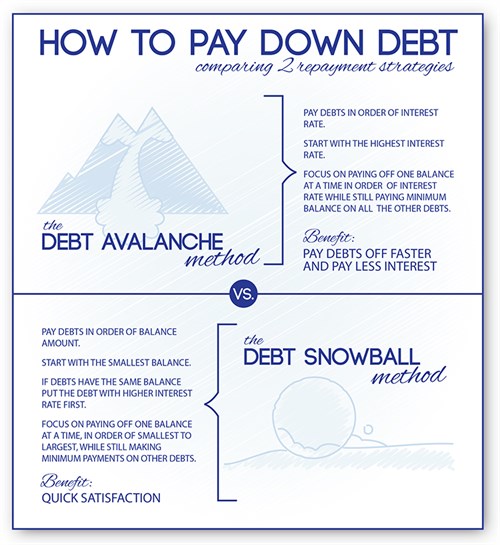

February should also be a fairly standard budget month. However, the couple will be receiving a tax refund! So what’s the best way to spend a tax refund? While everyone’s finances are different, debt and savings should be priorities for nearly everyone. Our couple can eliminate credit card debt with their refund of $2,100. Once this is complete, they can focus more on student loan debt in the months to come. They chose to eliminate credit card debt because of the Debt Avalanche. They are knocking out the debt with the highest interest rate first.

Additionally, they love to celebrate Valentine’s Day. So they have budgeted some extra money to cover dinner and presents.

INCOME

- Salary 1: $2,700

- Salary 2: $2,100

- Tax Refund: $2,100

TOTAL= $6,900

MONTHLY LIVING EXPENSES

- Groceries: $600

- Household Items: $50

- Clothing: $100 (back to normal)

- Cellphones (2 phones): $100

- Internet & Cable: $75

- Rent: $1,100

- Electric: $120 (increase for colder weather)

- Gas: $60

- Trash: $10

- Auto Maintenance: $40

- Auto Insurance (2 cars): $175

- Health & Dental Insurance: $350

- Renter’s Insurance: $10

- Entertainment: $110 (increase for Valentine’s Day)

- Netflix/Hulu: $20

- Gym Membership: $60

- Student Loan Payment: $425

- Auto Loan Payment: $175

- Vacation Fund: $0

- Pet Care: $75

- Credit Card Debt Payment: $2,550 (increase from tax refund)

- Savings & Investments: $695

- TOTAL: -$6,900

Our couple will continue to find debt relief and then start saving for their vacation again. They will continue to stash away money for an emergency fund in case another job loss or income disruption happens.

If you’re struggling to pay off debt, American Consumer Credit Counseling can help. Schedule a free credit counseling session with us today.