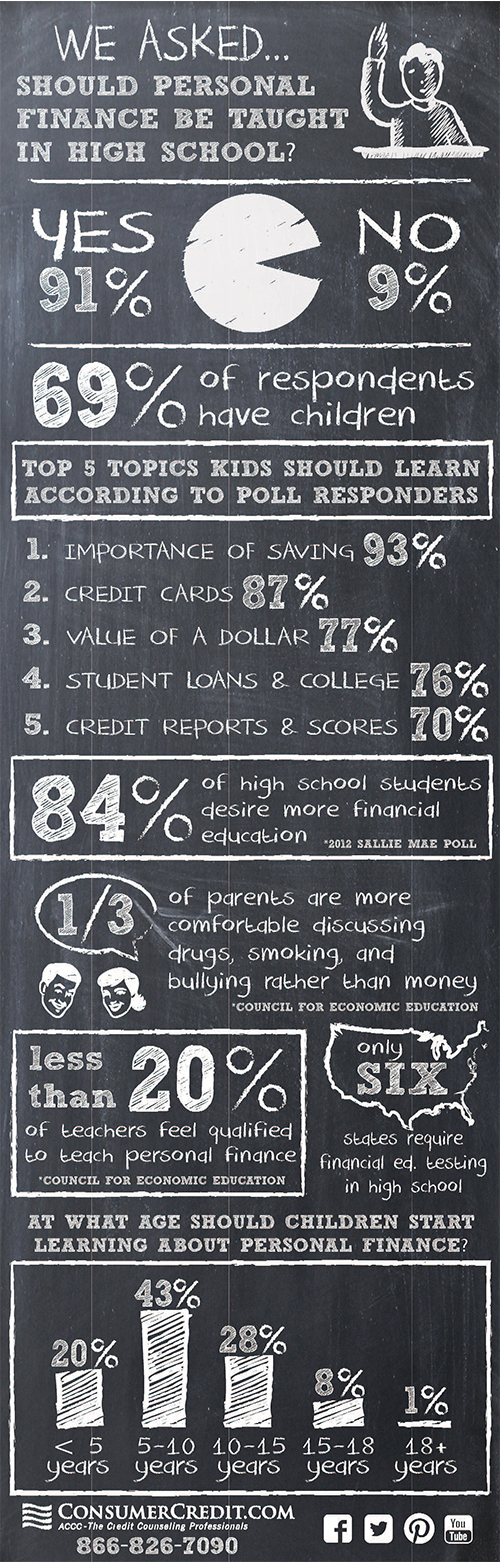

We celebrated Financial Literacy Month in April by posting shareable tips and resources each day to provide help for students and families preparing for college expenses. During April, American Consumer Credit Counseling also polled readers to find out their thoughts on the need for personal finance education among children and teens.

While 91 percent of Americans believe personal finance should be taught in high school, only six states actually require financial education testing before sending its students off to college or into the workforce. However, the majority of respondents believe that children should start learning about personal finance as early as five to ten years old. And it’s not just parents who are looking for more financial education in the classroom. A recent Sallie Mae poll found that 84 percent of high school students also would like more emphasis on the topic at school.

Visit ACCC’s Youth and Money Center for downloadable resources for teaching kids about money at any age.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.