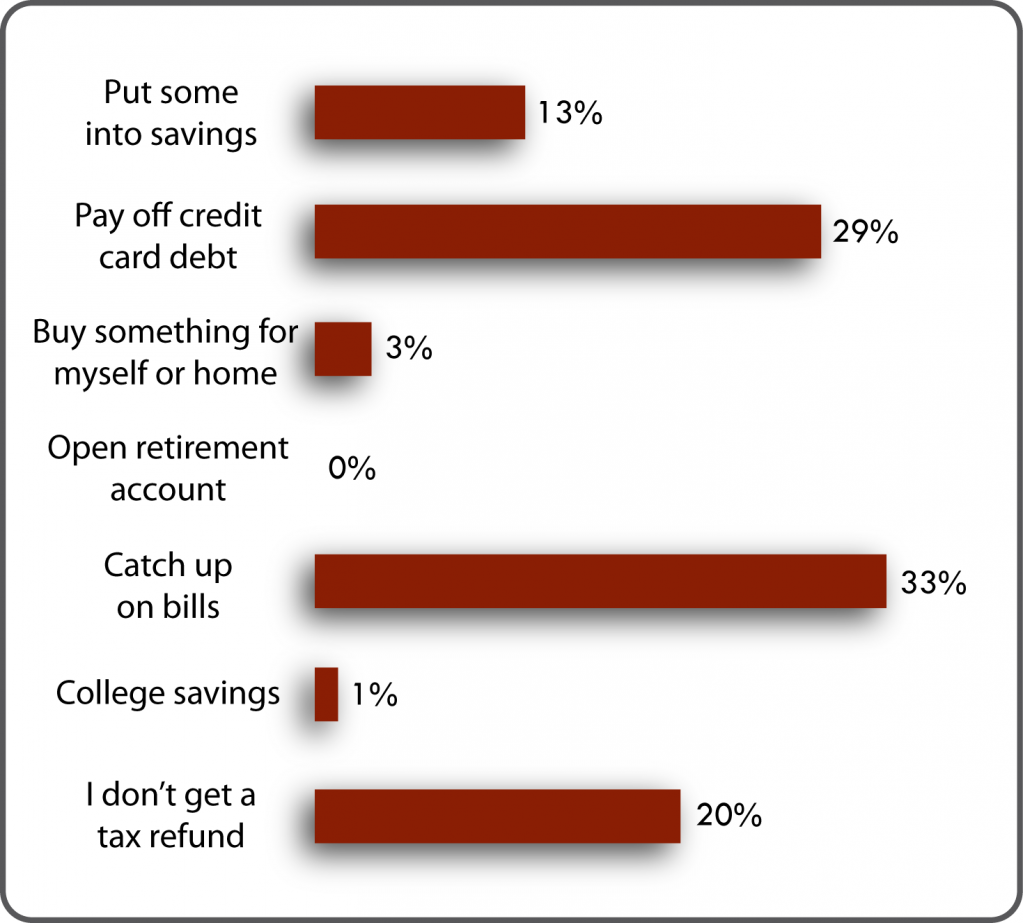

Every month, American Consumer Credit Counseling will post a poll question on its homepage. As a nonprofit credit counseling agency, we’re always interested in learning more about consumers’ habits. For the month of February, ACCC asked about your tax refund…

- What will you do with your tax refund in 2012?

Here’s what we found out…

Out of 721 Responses, here’s the breakdown…

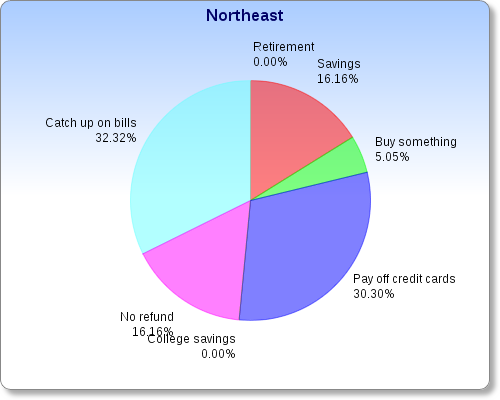

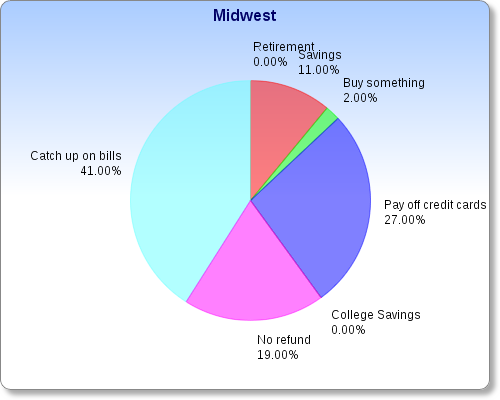

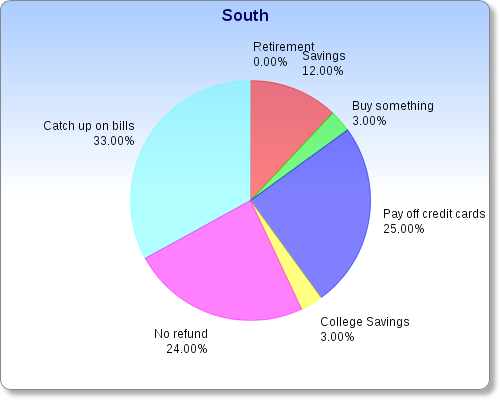

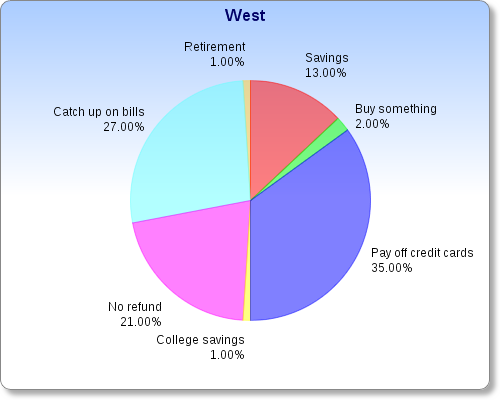

Here is how people responded in different regions…

So, what does the data tell us…

- The vast majority of Americans are using their refunds to catch up on debts, whether it’s credit cards or general bills.

- Almost no one is contributing their refund to a retirement account or college savings.

- Almost no one plans on spending their refund on a purchase.

- Overall, 75% of respondents will save it or put it towards debts.

- Responses are very similar across all regions of the USA.

This truly is a sign of the times. With credit card debt overwhelming many Americans in this economy, it’s no surprise that so many are putting their tax refund toward paying down debt and overdue bills. We assume that those putting it towards savings are lucky enough to have less debt issues. Basically, people are going to use their refunds to help their financial situations right now.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.