The home buying process is often overwhelming for a lot of people. Saving a good down payment can be a make or break point in your home buying efforts. While there may be options to buy with a smaller down payment, those options might not be the best fit. Here are some credit counseling tips to save for a home and manage your finances.

Tips To Save For A Home

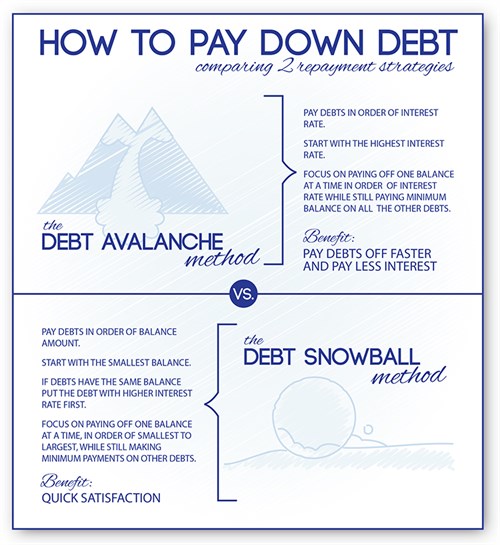

Work on Credit Card Payoff

Unpaid balances on your credit cards can often hinder the process of saving for a home. First, it’s important to deal with getting out of credit card debt. Being on track with these payments is a means to boost your credit score. This is a key factor when it comes to securing a good rate on your mortgage. Make sure you identify what method works best when it comes to debt management. Will you pay off the bigger balances or the higher-interest cards? Or would you need to look at consolidating debts as an option? Check out this financial infographic on debt repayment using the Debt Snowball and Debt Avalanche methods.

Work on Saving

Saving money is one of the biggest priorities when it comes to buying a home. It takes effort and commitment, and it you won’t see results overnight. Look at every possible avenue to save. Additionally, examine all possible parts of your budget because every penny is worth it! Finally, look hard at all of your expense categories to see which one can be reduced or eliminated. Saving for a down payment may take some sacrifices right now, but don’t forget: these temporary measures will help you work toward a worthwhile goal.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.