Many Millennials are still working hard to pay off student loan debt. While this debt isn’t necessarily a bad thing to have, it’s important to get rid of it. Eliminating debt frees up cash and looks good for any future loan prospects. Here are a few ways to pay down student loans faster.

Ways to Pay off Student Loan Debt Faster

Paying off student loan debt faster requires more money. That’s the reality. It’s simple, but it’s not necessarily easy. Here is a list of ways to increase your income or find more room in your budget. Every dollar helps!

Make More Money to Pay Off Student Loan Debt

- Ask for a raise (make sure you deserve it!)

- Work more if paid hourly

- Get a side gig

- Bartend or waitress

- Work retail on the weekends

- Stop spending on luxury or nonessential habits

- Bring your lunch to work

- Limit your dinner menu to simple meals like rice and beans

- Sell unused household items

- Sell your car and take public transportation

- Start couponing

- Limit vacations

- Find a cheaper apartment or barter for a discount on rent

- Make gifts for birthdays and holidays

- Try making your own repairs before calling a pro (assuming you have some skills)

- Babysit on the side

- Cancel cable or even Netflix for a while

- Stop buying new clothes

- Apply any extra paychecks

- Use your tax return

Applying Extra Money to Student Loans

Once more money starts coming in, send in extra payments that apply to the principle of the loans. Most online payments systems now have this an an easy option. If not, call the loan company directly and ask how to send in the extra payments. Typically, it just requires a little note with the payment describing where the money should be applied to.

There are two major benefits to a faster debt elimination than the scheduled repayment period. This extra money will pay down the principle which in turns means less money spent on interest. Borrowers with private loans will benefit most from this since the interest rate is usually higher than federal student loans. The other benefit to extra payments is the shortened repayment period. The loans will be paid back in full quicker than the standard 10 years. That means more money free to save, spend or donate!

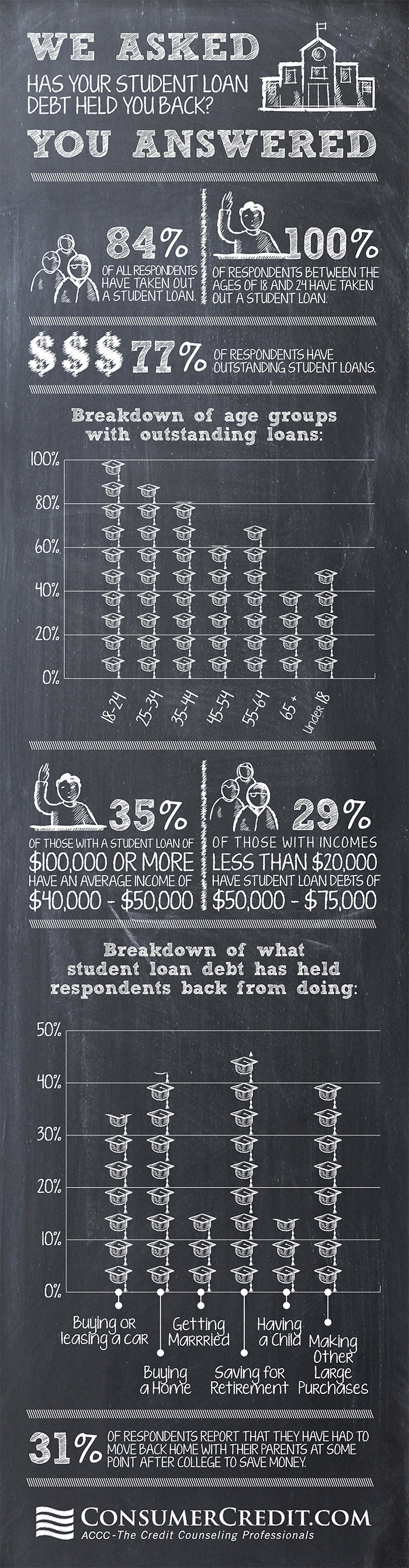

Check out ACCC’s infographic on student loans:

If you’re struggling to pay off debt, schedule a free credit counseling session with us today.