Debt Management Program

Debt Consolidation & Financial Freedom

Debt management plans, also known as debt management programs, offer a convenient solution for those with unsecured debt, such as credit card debt, collection accounts, and some personal loans. Rather than struggling to keep up with multiple payments and due dates, debt consolidation through a debt management plan enables you to make one monthly payment on the day that works best for you.

Benefits of ACCC Debt Management Program : ACCC’s debt management program helps you stay on top of your finances to become debt-free fast

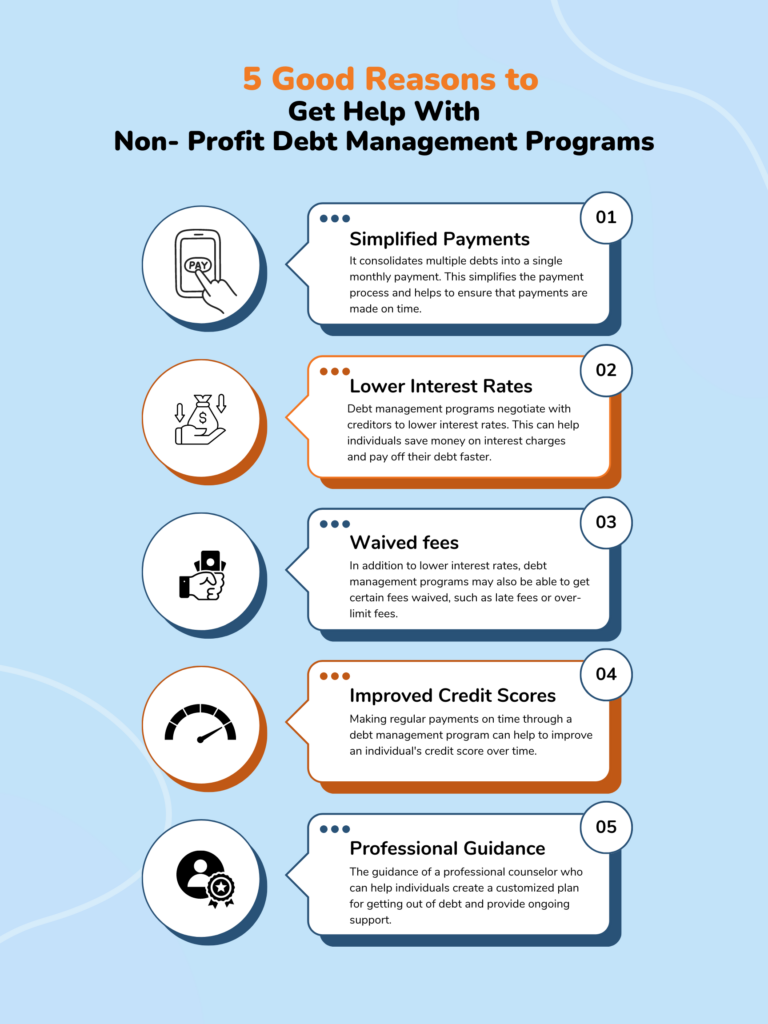

Apart from the convenience of a single payment, a good debt management program can offer many other benefits. These include but are not limited to:

- Organize your finances – The rigorous work you do with your certified counselors will help you come up with a carefully monitored budget. This type of constant monitoring can help you improve organizing your finances better.

- Get out of debt faster – Typically with a debt management program you can get out of debt within a three-to-five-year timeline.

- Reduced interest rates – The debt management program you are signed up with will negotiate with your creditors to lower your interest rates.

- Potentially Waived fees -Enrolling in a debt management program means that you now have a system in place to pay off debt. This means an end to collection calls, reduced finance charges and over-limit fees, and faster debt payoff.

At ACCC, certified and professional credit counselors are available to assist clients with exploring their debt management options. Our counselors are available round the clock to provide needed guidance and determine the most appropriate debt management plan for each individual’s unique situation. We offer a free debt counseling session to help qualified prospects gain a better understanding of their options and find the right debt management program for their needs.

How Does Debt Management Affect Credit Scores?

In addition to the benefits mentioned above, a debt management plan can also help individuals improve their credit score. By making regular payments, individuals demonstrate financial responsibility, which can increase their credit score over time.

More>> Why Credit Scores are Important

Who Should Use a Debt Management Program?

It is important to note that debt management plans are not suitable for everyone. Individuals with secured debt, such as a mortgage or car loan, may not be eligible for a debt management plan. Additionally, those with high levels of debt may need to explore other options, such as debt settlement or bankruptcy.

When considering a debt management plan, you should also be aware of any fees associated with the program. While some organizations offer free counseling sessions, there may be fees associated with enrollment in a debt management plan. However, these fees are often much lower than the fees and interest rates associated with unsecured debt.

Bottom Line…

Debt management plans can offer a convenient and effective solution for individuals struggling with unsecured debt. By consolidating debt into one monthly payment and potentially reducing interest rates and fees, debt management plans can help you become more financially organized and pay off debt faster. It is important to seek guidance from a certified debt counselor and a consumer credit counseling agency and carefully consider all options before enrolling in a debt management plan.

Help is Here. Get Free Credit Counseling Now